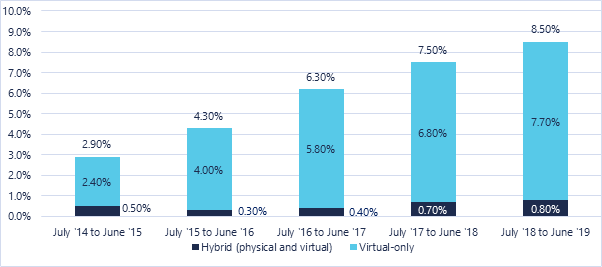

Over the last five years, virtual annual shareholder meetings have been a small, but growing, trend. While percentage increases have been significant year-over-year, overall a relatively small number of companies held virtual meetings in that time.

Figure 1. Percentage of Russell 3000 companies that had virtual meetings, ISS Analytics

In light of the novel coronavirus (COVID-19), and shelter-in-place orders and other restrictions on public gatherings, companies are grappling with annual meetings that cannot occur as originally planned, or at all.

Given the timing of the COVID-19 emergence, companies with December 31 fiscal year-ends are weighing a change to their annual meeting after filing their proxy statements and with little time until their annual meeting date.

One of the drivers that will impact a company’s options is whether the company has already distributed proxy cards and whether those same proxy cards can continue to be used in conjunction with any contemplated changes to the meeting.

While certain changes to the meeting may not require a new proxy card, others may. If new proxy cards are required to be distributed, this may restart the notice and access period.

One potentially complicating factor is the manner in which votes cast through proxy cards (for registered holders) and voter instruction forms (VIFs) (for holders who hold in street name) cards are tabulated – at some companies one vendor tabulates all votes, irrespective of how they are cast, while others split the tabulation between a proxy distribution vendor and their transfer agent.

Companies should contact their proxy distribution vendor, transfer agent or proxy solicitor to understand the status of their proxy cards and whether they can continue to be used in light of any changes to the meeting.

This determination will then drive a host of other decisions such as whether to adjourn (or postpone) the annual meeting, whether the future meeting should be virtual or in-person and whether a new record date will be required.

State-by-state restrictions on in-person gatherings and shelter-in-place requirements will also have an impact on available options both for the currently scheduled meeting as well as any adjourned (or postponed) meeting. Because this situation evolves on a daily basis, companies should prepare for a range of scenarios ahead of time.

If a company decides that a virtual meeting is the desired option, recent guidance from the Securities and Exchange Commission (SEC), proxy advisory firms and significant institutional investors are helping to guide this process in near-real time.

The below outlines the principal considerations for companies.

Considerations for companies considering a switch to a virtual-only meeting post-proxy filing

Are virtual-only meetings permitted in our state of incorporation?

As a threshold matter, a company must ensure it is incorporated in a jurisdiction that permits virtual-only meetings.

Many states, including Delaware, permit virtual-only annual meetings. But several states, including New York, currently require in-person annual meetings and other states permit virtual meetings only if they are hybrid meetings (meaning that the company is also concurrently hosting an in-person meeting).

Is our company permitted to hold virtual-only meetings?

While many states permit virtual-only meetings, some states, including Delaware, require the board to expressly authorize the ability to hold a virtual meeting.

Companies should review their organizational documents or otherwise confirm any required authorization exists and that the organizational documents do not require in-person meetings or prohibit virtual meetings.

If there are prohibitions on virtual meetings or other issues or requirements, companies should consider whether a bylaw amendment or a board resolution will be sufficient to permit the virtual meeting to go forward.

These issues may require a special meeting of the board and quick action, and companies should prepare their board for this possibility.

Whom do we need to involve?

For companies considering a switch to a virtual meeting, it will be important to alert promptly necessary parties and team members to enable a rapid and seamless transition. Internally, this generally includes the Board, the executive management team, legal and IR.

Externally, outside lawyers, a proxy distribution vendor, the transfer agent, the inspector of elections (if different than the transfer agent), any external PR firm and the virtual meeting vendor should be notified as soon as possible. The company should also update its auditors and its securities exchange.

How do we get the word out?

SEC filings – The SEC put out guidance on March 13, 2020 that confirmed the view that a company that has already mailed and filed its definitive proxy materials can notify shareholders of a change in the date, time, or location of its annual meeting without mailing additional soliciting materials or amending its proxy materials if it takes the following steps:

- issue a press release announcing the change of format;

- file the press release as supplemental proxy materials on EDGAR; and

- promptly notify the relevant parties noted above.

See below for additional considerations for a press release and/or supplemental filing materials to take into account the views of the SEC and proxy advisory firms.

The SEC’s guidance on this topic also includes the expectation that companies will provide timely disclosure to shareholders, intermediaries and other market participants that include clear logistical directions and how shareholders access, participate and vote at a virtual meeting.

If this is not known at the time of an initial press release announcing the change in format, a follow-up press release and supplemental filing may be advisable. In addition, the initial press release should, to the extent possible, note that additional information will be provided.

State requirements – Most states require notice of the meeting to be provided to shareholders during a certain timeframe. For example, in Delaware, notice must be given no fewer than ten and no more than sixty days before a meeting. The press release filed as supplemental materials should be sufficient in Delaware if the meeting date is more than ten days away.

Websites – Updates will need to be made to the website hosting proxy materials and the company’s website.

Notices at meeting location – If possible, it is also advisable to post a notice at the meeting location (or at the entrance point to any meeting location) advising that the meeting will be held virtually so that any shareholder that has not seen the press release or SEC filing and turns up at the meeting location will know how to access the meeting virtually.

How do we handle voting?

Companies that have already filed their proxy statements have likely begun receiving returned proxy cards and reissuing proxy cards or VIFs.

Although companies will not be required to re-send proxy cards or VIFs if they comply with the SEC’s filing guidance, as noted above, companies should consult with their proxy distribution vendor and transfer agent on whether logistical considerations will nonetheless require that companies distribute new proxy cards, which would potentially trigger a new notice-and-access period.

If this is the case, as noted above, this would have a cascading set on consequences for the annual meeting.

Ensure there is a system in place with your meeting vendor, proxy solicitor and inspector of elections to accommodate different forms of voting, including virtual voting at the annual meeting.

What do we do about logistics?

- Find a service provider to host the annual meeting. Some of the existing outside vendors provide this service. In light of the timing considerations, companies will want to work with a provider that can nimbly assist with logistical options and best practices and ensure that there is enough time for all of the logistical procedures to be accomplished in time.

- Notify relevant intermediaries and other market participants on how shareholders can access the meeting.

- Review expectations of proxy advisory firms (see below) and other investors (if and when they are released) and discuss the expectations and plans to align meeting practices with the chosen service provider.

- Determine how to involve the board and whether they are physically or virtually present with management.

- Develop a process for the administration of shareholder proposals, including the shareholder presentation portion. Make sure to coordinate with any shareholder proponents (or their representatives) in advance.

- Determine how to administer shareholder questions at a virtual meeting. Companies that host virtual meetings generally have adopted procedures for shareholder participation.

- Reconsider the existing rules of conduct at the meeting in light of a virtual meeting and make adjustments and changes as necessary. If a company has not historically had rules of conduct for their in-person meetings, consider adopting rules of conduct for the virtual meeting.

- Review and adjust the meeting script and Q&A, as necessary. Anticipate that a switch to a virtual-only meeting may raise additional questions, including about the company’s response to and views on COVID-19. If any of the content of the annual meeting is expected to be material, ensure that the annual meeting (and Q&A portion) is in compliance with Regulation FD (or, conversely, ensure that any material information is disseminated in accordance with Regulation FD ahead of the meeting).

How will shareholders access the meeting?

The meeting vendor will be able to assist. A company switching its annual meeting may have fewer options for access, and the company should discuss with its vendor the best way to maximize accessibility (e.g. it may be more difficult to provide access through smart-phone scanning or QR codes without resending proxy cards).

What if there’s no time?

In most states it is possible to postpone a meeting to a later date and time and different location.

However, for companies that have sufficient time to make the switch to a virtual-only meeting, note that postponements can be subject to challenges, and the company will need to be clear that the board acted in the best interests of the company’s shareholders.

In addition, in some states, shareholders can sue to compel an annual meeting if none has been held within a certain amount of time since the prior meeting (e.g. 13 months in Delaware).

Litigation risk is likely to be very low, as courts may be willing to be lenient for companies grappling with these issues in real time.

Companies should consult with their outside counsel on how to manage postponement and adjournment issues, risks and potential mitigations depending on their individual circumstances.

How will our investors feel?

The COVID-19 circumstances currently leading companies to consider changing their annual meeting to a virtual-only meeting constitute unexpected and extenuating circumstances. Nonetheless, it is important to remember that, at least historically, virtual-only shareholder meetings have been the subject of some criticism.

While some significant investors and groups historically have opposed virtual-only meetings, including the New York City Comptroller, CalPERS and The Council of Institutional Investors (CII), some investors have publicly stated a divergence from their public stances in light of COVID-19 for this year.

The New York City Comptroller announced that it will suspend its practice of voting against governance committee members at companies that hold virtual-only meetings if companies disclose that a virtual-only meeting was chosen due to COVID-19 concerns and “affirm their commitment to holding in-person meetings in the future”.

CII also provided a statement to thecorporatecounsel.net noting that CII believes that COVID-19 concerns are a reasonable basis to switch to virtual-only meetings this year. However, like the NYC Comptroller, they would prefer that companies note that this is a temporary change.

Glass Lewis amended its proxy voting guidelines (PDF) in 2018 to provide that it expects “robust disclosure in a company’s proxy statement which assures shareholders that they will be afforded the same rights and opportunities to participate as they would at an in-person meeting”.

While there have not yet been any official updates to the policies of ISS or Glass Lewis in light of COVID-19, Kingsdale Advisors reports that both ISS and Glass Lewis will take COVID-19 considerations into account for companies switching to a virtual meeting, with sufficient disclosure.

However, we also expect that the handling of virtual meetings this year is likely to impact ISS’ view of virtual meetings on a go-forward basis. Companies should assume that this will be true of all proxy advisory firms, as well as significant institutional investors.

What should my company disclose in light of proxy advisory firm recommendations?

- Information on how to access the meeting. (Glass Lewis)

- Explicit information about the change to a virtual meeting, and specifically that the change is due to COVID-19 considerations. (Glass Lewis)

- That there will be no limitation on participation rights (ISS).

- Shareholder ability to:

- participate in a virtual meeting (ISS);

- ask questions (Glass Lewis); and

- have two-way communication (ISS), including the ability for shareholders to be critical of a company’s performance or governance and present shareholder (ISS).

For companies with rapidly approaching annual meetings, the initial notice should focus on disclosing the change in format and any change in date and timing. A company may supplement this initial disclosure with additional logistical details as they become available.

For more insights following the Spring M&A and Governance Forum and other corporate law issues, visit our US corporate perspective hub.